What is Identity Theft?

Identity theft is when someone steals your personal information to obtain goods and services. From fraudulently opened bank accounts to getting medical care in your name, the list of ways identity theft can impact you is practically endless.

Understanding

identity theft

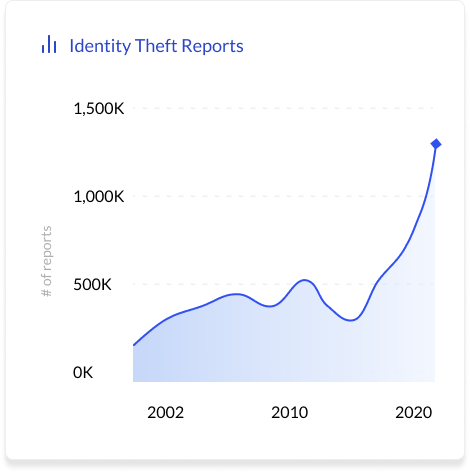

Unfortunately, identity theft isn’t rare. Actually, it’s the opposite—it’s one of the world’s fastest-growing crimes: fraud claims have risen by over 400% since 2010, leading to over $3.3 billion in losses.

In the time it takes to read this page, 10—yes, 10—more people will be victimized by identity thieves.

These fraudsters gather personally identifiable information, like your Social Security number, private usernames and passwords, etc. so they can:

• Get medical care in your name

• Fraudulently bill your clients or customers

• Take out and charge credit cards in your name

• Make purchases with your banking information

Identity thieves pose as you to get all kinds of goods and services—at your expense. It’s no picnic when it happens—identity attacks can have long-term impact on your financial and personal well-being.

So be careful about what information you give out. You should also diligently watch for credit irregularities and anything else that looks suspicious. You can recognize identity theft by:

• Discovering surprise credit lines taken out in your name

• Finding a dossier of your private information on the dark web

• Noting account login attempts that were not yours

The most comprehensive way to fight identity theft is by hiring a professional identity theft protection service such as IDShield.

Recognizing identity theft

There are several different types of identity theft, each of which can be personally and professionally disastrous.

Synthetic identity theft

Synthetic identity theft is when a thief steals personal information from several people and then synthesizes information from each in order to create a new, fictitious identity.

Thieves steal your name, Social Security number, date of birth, and any relevant government documentation, combine it with a stranger’s information, and harm everyone involved by racking up credit or obtaining services at multiple people’s expenses.

Unfortunately, this is one of the most common types of ID fraud.

New account fraud

Thieves will often use your personal information to create new credit card, utility, or cell phone accounts.

Some thieves even take accounts out in children’s names. And because children don’t typically have credit reports, this sort of fraud can go undetected for years.

Account takeover fraud

Account takeovers are difficult to detect. Simply monitoring your credit information is insufficient.

An account takeover looks like this: a thief gets a hold of your login credentials in order to access your banking information. The thief can then make transfers, general information changes, and credit card requests, which your bank thinks you’re making yourself—that is, your bank thinks these are legitimate transactions. A thief can do this more or less indefinitely if they add themselves—under a false name, of course—as an authorized user on your account.

Medical identity theft

Medical identity theft is particularly dangerous. This type of identity theft is generally used by drug seekers.

Once they have your personal and medical information in hand, thieves can fill and collect your prescriptions, alter your medical forms to reflect a false need for their medication of choice, and generally create high-stakes mischief by altering your most urgent private information.

Erroneous information can follow you from practice to practice across many years, potentially resulting in grievous injury should your medical treatment plan be based on falsified information.

Theft is on the rise

Reports are up by over 400% since 2010 and it’s led to over $3.3 billion in losses. In the time it took you to read this page, there were 10 new identity theft victims.

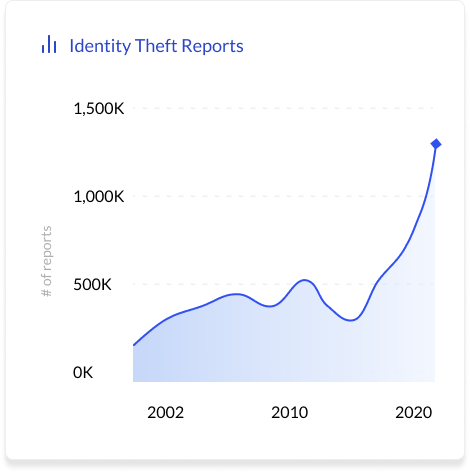

Theft is on the rise

Reports are up by over 400% since 2010 and it’s led to over $3.3 billion in losses. In the time it took you to read this page, there were ten new identity theft victims.

How can I defend against identity theft?

IDShield’s identity theft protection suite includes full identity protection, identity restoration, financial protection, ID Theft Defense ™ credit monitoring, and digital device protection. We monitor your personal and financial information 24/7. When we detect fraud, we work to restore your identity quickly.

Pick a plan, sign up, and let IDShield do what we do better than anyone else.

Choose a plan that works for you

Enrolling only takes a few minutes.

Get started today!

Our Individual and Family plans come with the same premium features.

Individual Plan

What You’ll Get

- Protects one person

- Access to premium features

- Choose 1 or 3 credit bureau monitoring

Starting as low as

$14.95/month

Family Plan

What You’ll Get

- Protects you, your spouse or domestic partner, and dependents under 18 living with you

- Access to premium features

- Choose 1 or 3 credit bureau monitoring

Starting as low as

$29.95/month

Shout it from

the rooftops

FAQs

Find answers to our most frequently asked questions.

What is the definition of identity theft?

Identity theft is the third-party use of your personal information to obtain goods and services without your knowledge or consent.

What is the cause of identity theft?

Identity theft is a result of your personal data being exposed by bad actors, through hacking, phishing, data breaches, or other malicious means.

What are the warning signs of identity theft?

Suspicious or unknown transactions on your bank statements, unfamiliar credit card charges, new lines of credit in your name, calls from debt collectors, and an unexpected drop in credit score may all be indicators of identity theft.

How do I prevent identity theft?

Be intimately familiar with account transactions, freeze your credit, use strong passwords, and add an authentication, subscribe to notifications and alerts, shred paper documents that contain PII.